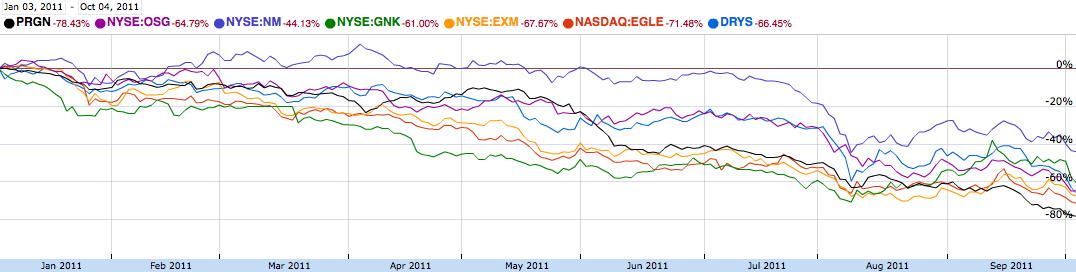

The market appears to continue to anticipate that at least some of these ocean carriers have a high probability of exiting the market. Several competitors within the sector are trading below book value, and also liquidated valuations, with fear of bankruptcy and/or selling off ships.

DryShips, Inc (DRYS)

Eagle Bulk Shipping, Inc. (EGLE)

Excel Maritime Carriers, Ltd. (EXM)

Genco Shipping & Trading Ltd. (GNK)

Navios Maritime Holdings Inc. (NM)

Overseas Shipholding Group Inc. (OSG)

Paragon Shipping Inc. (PRGN)

more

The beta of an asset within a portfolio is

\beta_a = \frac {\mathrm{Cov}(r_a,r_p)}{\mathrm{Var}(r_p)},~

where ra measures the rate of return of the asset, rp measures the rate of return of the portfolio, and cov(ra,rp) is the covariance between the rates of return. The portfolio of interest in the CAPM formulation is the market portfolio that contains all risky assets, and so the rp terms in the formula are replaced by rm, the rate of return of the market.

No comments:

Post a Comment